sales tax calculator reno nv

Local rate range 0-3665. Select the Nevada city from the list of cities starting with R below to see its current sales tax rate.

Lv No Sales Tax Sema Data Co Op

The Nevada sales tax rate is currently.

. Nevada has recent rate changes Sat Feb 01 2020. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Nevada local counties cities and special taxation. 4 beds 25 baths 2303 sq.

Get a quick rate range. Counties are able to impose county option taxes up to 8 cents per gallon. The base state sales tax rate in Nevada is 46.

Zillow has 1249 homes for sale in Reno NV. Our Certified Software Makes It Easier to Manage Multi-State Tax Compliance. Nevada sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache.

Local sales tax rates can raise the sales tax up to 8375. Some dealerships may also charge a 149 dollar documentary fee. You can print a 8265 sales tax table here.

The current total local sales tax rate in Reno NV is 8265. Nevada state sales tax rate range. The County sales tax rate is.

Out-of-State Dealer Sales - An out-of-state dealer may or may not collect sales tax. 4920 Lakeside Dr Reno NV 89509-5830 668500 MLS 220005289 Location location location. Many dealers remit sales tax payments with the title paperwork sent to the DMV Central.

In addition to taxes car purchases in Nevada may be subject to other fees like registration title and plate fees. Sales between licensed suppliers are tax-free. With local taxes the total sales tax rate is between 6850 and 8375.

See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Reno NV. Nevada Gasoline and Fuel Taxes for 2020 Nevada Aviation Fuel Tax. The table below shows the county and city rates for every county and the largest cities in the state.

Nevada Dealer Sales - Taxes are paid to the dealer based on the actual purchase price. Sale Tax History for 4920 Lakeside Dr. This is the total of state county and city sales tax rates.

The minimum combined 2022 sales tax rate for Reno Nevada is. As you enter this charming townhome you. The Reno sales tax rate is.

Auto Sales Tax amortized over 6 years Yearly Property Tax. Sales made to end user or retailer. Local tax rates in Nevada range from 0 to 3665 making the sales tax range in Nevada 46 to 8265.

Base state sales tax rate 46. This is an increase of 18 of 1 percent on the sale of all tangible personal property that is taxable. Phone numbers and more for Sales Tax Calculator locations in Reno NV.

There is no city sale tax for Reno. The total overlapping tax rate subject to approval by the Nevada Tax Commission for the City of Reno is 3660615 per 100 of assessed valuation. Sales tax is a tax paid to a governing body state or local on the sale of certain goods and services.

In Nevada Aviation Fuel is subject to a state excise tax of 002 per gallon. The 8265 sales tax rate in Reno consists of 46 Nevada state sales tax and 3665 Washoe County sales tax. Therefore a home which has a replacement value of 100000 will have an assessed value of 35000 100000 x 35 and the home owner will pay approximately 1281 in property taxes 35000 x 3660615.

Mar 06 2015 Recent. 2 beds 15 baths 1220 sq. Sales Tax Nevada Reno.

NV Sales Tax Rate. Effective January 1 2020 the Clark County sales and use tax rate increased to 8375. For tax rates in other cities see Nevada sales taxes by city and county.

There is no applicable city tax or special tax. 2022 Cost of Living Calculator for Taxes. In the 2011 Legislative Session reduced the interest rate to 075 or 0075 from 1 or 01 effective 712011.

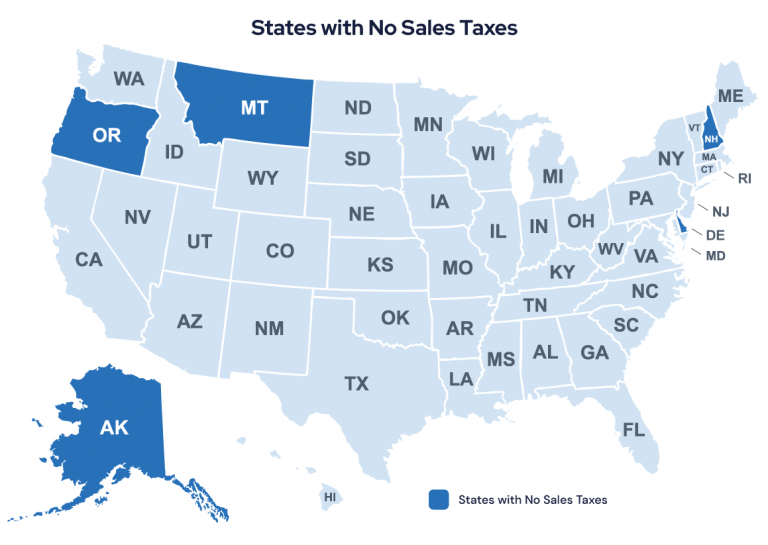

Low property taxes and the absence of any state or local income taxes in Nevada can make it a particularly affordable place to own a home. See the Nevada Department of Taxation Sales and Use Tax Publications for current tax rates by county. Nevada Sales Tax Nevadas statewide sales tax rate of 685 is seventh-highest in the US.

Ad Your Business Can Automate Sales Tax and File Returns for Free in 24 States with Avalara. Find your Nevada combined state and local tax rate. 428 Smithridge Park Reno NV 89502-5761 314895 MLS 220006057 A slice of heaven in the heart of Reno.

Nevada largely earns money from its sales tax which can be one of the highest in the nation and varies from 685 to 8375. Due to varying local sales tax rates we strongly recommend using our calculator below for the most accurate rates. Assumes a new 25000 Honda Accord and Sales Tax is amortized over 6 years.

You can find these fees further down on. The December 2020 total local sales tax rate was also 8265. The correct tax rates will display based.

Total rate range 46-8265. Nevada NV Sales Tax Rates by City R The state sales tax rate in Nevada is 6850. Nevada collects a 81 state sales tax rate on the purchase of all vehicles.

Reno Nevada and Ventura California. The Reno Nevada general sales tax rate is 46Depending on the zipcode the sales tax rate of Reno may vary from 46 to 8265 Every 2020 combined rates mentioned above are the results of Nevada state rate 46 the county rate reno nevada sales tax 3665.

7 Tips For A Successful Real Estate Property Search Mashvisor Property Search Real Estate Estates

Oklahoma Sales Tax Calculator Reverse Sales Dremployee

The Nevada Income Tax Rate Is 0 This Does Not Mean You Will Not Be Taxed On Your Earnings

How To Calculate Cannabis Taxes At Your Dispensary

Sales Taxes In The United States Wikiwand

Nevada Income Tax Nv State Tax Calculator Community Tax

Lv No Sales Tax Sema Data Co Op

Lv No Sales Tax Sema Data Co Op

How To Calculate Cannabis Taxes At Your Dispensary

Total Sales Tax Rate Nevada Turbotax Sema Data Co Op

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Nevada Income Tax Nv State Tax Calculator Community Tax

Nevada Income Tax Nv State Tax Calculator Community Tax

Nevada Income Tax Nv State Tax Calculator Community Tax